Karachi: The record-breaking devaluation of the rupee finally halted as the dollar lost Rs3.4 in the interbank market on Thursday after a reported assurance from the Saudi government to provide $2 billion for deposits.

The currency market took the assurance seriously with the hope that the IMF will finally release the much-needed tranche to unlock the inflows from other sources.

The State Bank reported the closing price of the dollar as Rs284.42 against Rs287.85 on Wednesday. The rupee appreciated by Rs3.42 or 1.21 percent.

After uncapping the exchange rate, the dollar kept increasing against PKR but was moving in the range of Rs280-285 for the last couple of weeks.

However, the PKR started losing to set a new record as it reached Rs287.85. The currency dealers and experts were expecting the dollar at Rs300 while the open market had crossed Rs295 a day before.

“I believe the PKR appreciated against the US dollar only because of the reports that appeared in the media that Saudi Arabia was ready to provide $2bn to keep in the account of State Bank,” said Zafar Paracha, general secretary of the Exchange Companies Association of Pakistan.

Hopes were high in the market after this disclosure of this $2bn news. The finance minister is scheduled to visit the UAE for another $1bn required to fulfill the IMF demand. Pakistan needs to improve its foreign exchange reserves before becoming eligible for the IMF tranche.

“It looks like the government will succeed in convincing the IMF,” said a researcher, adding that the situation would be clear once the IMF announces its satisfaction.

He also said PML-N supreme leader Nawaz Sharif would visit Saudi Arabia to perform Umrah which may lead to a meeting with the Saudi authorities and the release of the much-needed $2bn Saudi fund.

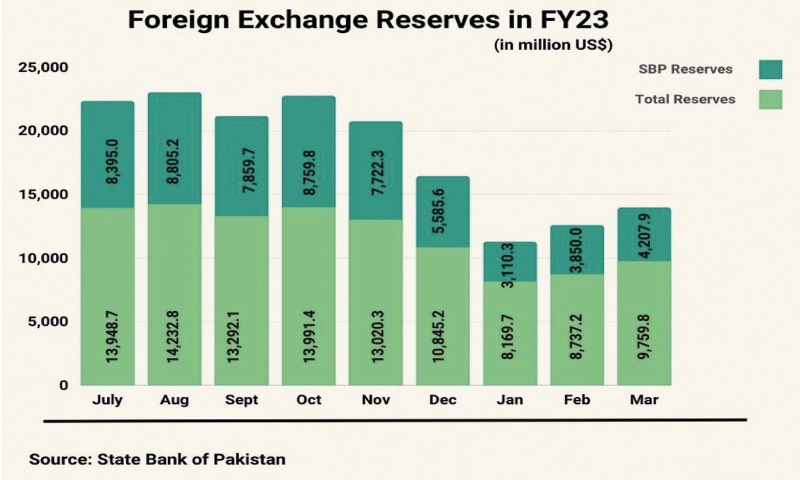

Several figures have been reported in the media for the current financial year FY23 that Pakistan required unlocking the IMF inflows. After the monetary policy was announced on April 4, the State Bank governor while answering questions stated that out of the $23bn that had to be repaid within the current fiscal year, most payments have either been rolled over or made.

Topline Securities reported that the SBP governor said that $4.5bn has to be repaid by the end of June out of which $2.3bn will be rolled over and $2.2bn has to be repaid to bilateral and multilateral lenders. Only $100m has to be repaid to commercial lenders.

Courtesy: Dawn 2023!